Citi-Tsao Foundation Financial Education Programme for Mature Women

Women are more likely to be economically dependent in old age because of lower overall labour force participation and because they also tend to be paid less than men for the same work or work of equal value.

Background & Rationale

In 2008, Tsao Foundation initiated the Citi-Tsao Foundation Financial Education Programme for Mature Women in partnership with Citi Foundation and Citi Singapore to address the financial vulnerability of low-income, mature women aged above 40 years old. The programme was a proactive intervention that also highlighted to key policy makers the critical need for gender-informed public policies in ensuring financial security for old age. The programme has also been adapted in Indonesia and recently in Malaysia. More countries in the Southeast and East Asian region, in particular, have expressed interest in initiating a similar program for their cohorts of mature women.

This development comes at the heels of an increasing awareness and concern over a rapidly ageing population and the phenomenon of feminization of ageing. Women worldwide have a higher life expectancy than men which means women will form the majority of the elderly population. Fewer older women are also economically active all over the world and similarly, in the region. Women are more likely to be economically dependent in old age because of lower overall labour force participation and because they also tend to be paid less than men for the same work

or work of equal value. Many older women provide care for, or are the sole caregivers of, dependent young children, spouses, partners or ageing parents and are largely unpaid for this care work.

Spending their lifetime of work in the informal sector or in unpaid care essentially excluded many older women from accessing private health insurance or from state-provided schemes, pensions and social security. Due these, women are particularly vulnerable to poverty in old age.

The Regional Learning Network on Women’s Financial Security in Old Age aims to bring together key policymakers from the 10 member countries and country partners of the ASEAN Plus 3, relevant NGOs, policy think tanks and international organizations and leading academics, to bring attention and action on the issue of financial security among older women.

Implications for Women

The Network has the following objectives:

- To raise awareness on the current state of older women in the region with specific focus on their income and financial security;

- To catalyse mainstreaming of gender in policy and program development;

- To build public-private partnerships that will promote more effective policy-action translation in addressing the issue;

- To promote networking and workgroups, learning exchanges and partnerships with broader regional organizations for advocacy;

- To initiate research collaborations for policy analysis and program evaluation; and

- To create an online platform for sharing of findings, data, best practices, model-building programs and other resources.

Women’s Story in Numbers

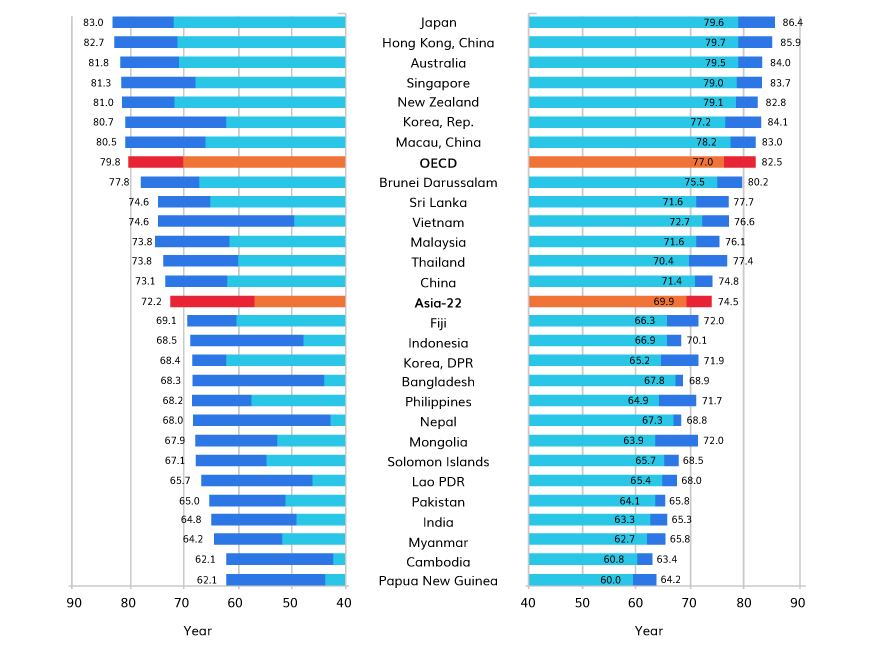

In Asia, Women are Living Longer

Left:Life expectancy at birth, 1970 and 2010, and by sex, 2010

Source: OECD analysis of World Bank / UN population database

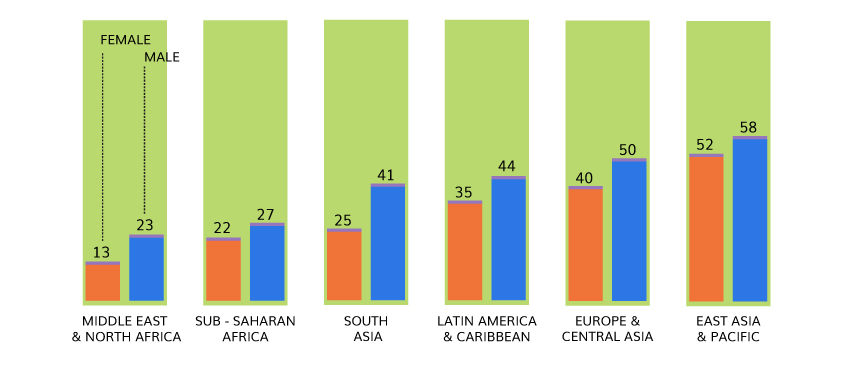

Women are Less Represented in Formal Workforce

Employed females per 100 employed males

And Only Partially Control Their Own Earnings

Decisions on use of women's earnings (currently married women in employment aged 15-49)

Source: StatCompiler, Measure DHS Surveys 2010-2013

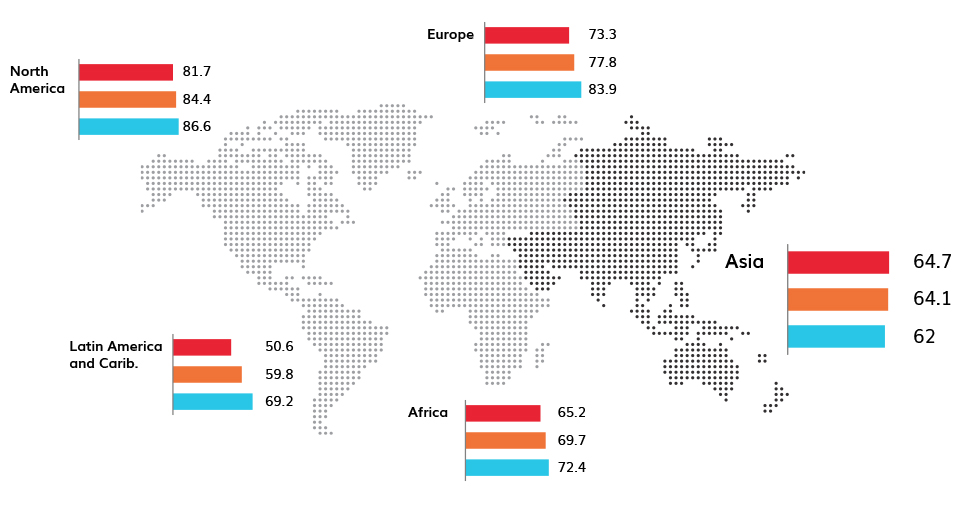

Women Have Less Access to Finance

Bank Ownership by Region

Source: Demirguc-Kunt and Klapper, 2012: Average for Asia region (Cambodia, China, Hong Kong SAR, China,Indonesia,Japan,Korea, Rep.,Lao PDR,Malaysia,Mongolia, Philippines, Singapore,Taiwan,Thailand,Vietnam)

They are less likely to save formally and more likely to save informally

Implications for Women