Scholars highlight women’s financial vulnerability in ageing East and Southeast Asia

East and Southeast Asian countries are ageing fast and a key challenge of this demographic trend is women’s incapacity in meeting financial needs in old age.

1. Guest-of-Honour Senior Minister of State Dr Amy Khor with Mr Michael Zink, Head of ASEAN Citigroup, Citi Country Officer Singapore and Ms Susana Harding, Director of International Longevity Centre Singapore, an initiative of Tsao Foundation. 2. Guest-of-Honour Senior Minister of State Dr Amy Khor, Ministry of Manpower and Ministry of Health & Member of Parliament. 3. Keynote Speaker Dr Donghyun Park, Principal Economist, Asian Development Bank

This critical issue was the highlight of the First Multipartite Regional Meeting on the Financial Security of Older Women in East and Southeast Asia on 15-16 January 2015. More than 50 participated in this inaugural convening from seven countries and governments all over the region: Brunei Darussalam, Hong Kong, Indonesia, Malaysia, Philippines, Singapore and Vietnam representing policymakers, programme practitioners and researchers in the areas of ageing, finance, economy and population planning.

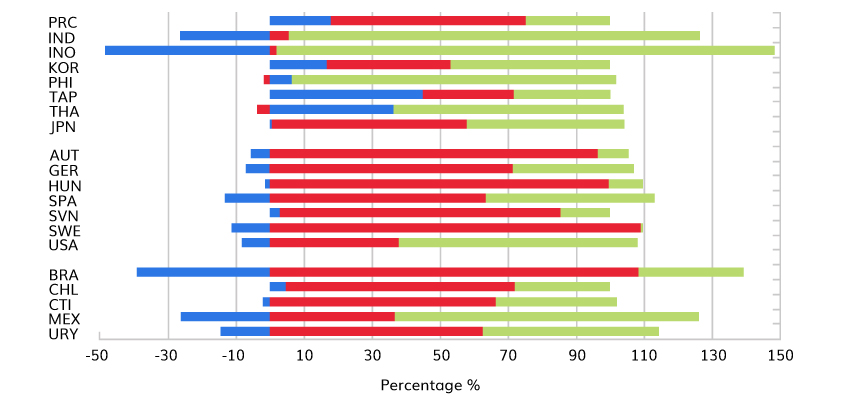

Dr Donghyun Park, Principal Economist, Asian Development Bank (ADB) presented data from various ADB researches to provide a regional perspective on population ageing.

He noted that the end to the region’s demographic dividend—a large working age population with high savings rate—which in the recent decades paved the way for its tremendous economic growth will be inevitable.

However, to highlight the opportunity that longevity can bring, Dr Park pointed out that “if the needs of the elderly are met largely through lifecycle saving, this can give rise to ‘second demographic dividend’.” He said governments should inform their publics of this demographic shift and help them make appropriate financial decisions. He also noted that this shift should be an incentive for promoting women’s participation in the workforce.

Family support is declining in Asia, but public transfers are underdeveloped

Inequalities faced by women

Professor Elaine Kempson, Emeritus Professor & Director, Personal Finance Research Centre, University of Bristol, provided an overview of the complex and diverse causes of the inequalities faced by women in achieving financial security. Noting that “pensions through intergenerational transfers are unlikely to sustain women’s financial needs in the long term”, she said that tackling the issue requires a comprehensive approach.

Professor Kempson highlighted four areas with specific suggestions: 1) tackling inequalities in the labour market through childcare provision, equal pay and equal opportunities legislation; 2) designing pension plans that are appropriate to women’s needs and patterns of labour market participation; 3) designing pension systems that overcome women’s behavioural biases and provide them with good regulatory protection; and 4) complementing this with appropriate interventions to raise women’s financial capability in the area of pensions.

Dr Joanne Yoong, Director, Center for Economic and Social Research (East), University of Southern California, presented a cross-section of comparative country-level studies (mostly among non-Asian countries) suggesting a substantial difference in financial literacy by gender. She also provided insights on interventions that proved to work in helping women improve their financial literacy.

Workshop speaker Dr Joanne Yoong, Director, Center for Economic and Social Research (East), University of Southern California

She noted that there remain some critical gaps in Asia—for national studies of financial literacy by gender and rigorous gender-aware evaluation of financial education programs. To address these gaps, Dr Yoong recommended 3 main directions: 1) to include both research and gender in national financial literacy strategies; 2) to build the capacity of both researchers and policymakers; and 3) to create platforms for networking and sharing through peer-to-peer learning.

Keynote Speaker Professor Elaine Kempson, Emeritus Professor& Director, Personal Finance Research Centre, University of Bristol

Singapore, being the fastest ageing nation in the ASEAN region, spearheaded the initiative through the Tsao Foundation’s International Longevity Centre Singapore. The regional convening’s Guest of Honour, Singapore’s Senior Minister of State Dr Amy Khor (Ministry of Health and Ministry of Manpower & Member of Parliament) and Adviser to the largest organization of women’s grassroots leaders emphasized the government’s concern and commitment to addressing the challenge.

She shared Singapore’s policies in support of women’s active participation in the workforce and the various initiatives at the policy and community levels which aim to help women access financial education and prepare for old age needs.